Published April 9, 2021 | 4 min read

Key Points

- Younger consumers’ “buy now, pay later” (BNPL) mindset is reshaping online point-of-sale (POS)

- Frictionless commerce has redefined point-of-sale (POS) systems and accelerated the need for omnichannel payment technology

- As consumers turn to apps to manage their finances, tech companies are expanding banking-like services such as payments, savings, and investments

- The global pandemic fast-tracked banks’ adoption of digital and cloud solutions

- Cyclical exposure, stock price underperformance, and digital-enablers may top post-pandemic recovery themes

The pandemic not only propelled a massive shift to online shopping and e-commerce, it also set the stage for disruption in the payments and processing ecosystem.

“Buy now, pay later” (BNPL) consumers demanding faster, simpler, and more secure payment methods are transforming online point-of-sale (POS) systems. And, as many consumers switch to “super” apps to manage their finances and investments, tech companies are looking to make a bigger push into the banking arena through mergers and acquisitions, or competitive offerings.

Last year, over half of our Payments, Processing, and IT names outperformed the S&P 500. In this report, we examine how disruption in this sector may support continued investment and growth in 2021.

Here are our key takeaways:

Younger demographic adopts “buy now, pay later” mindset

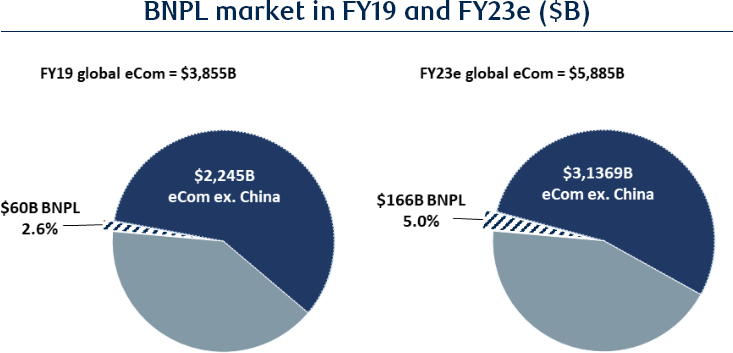

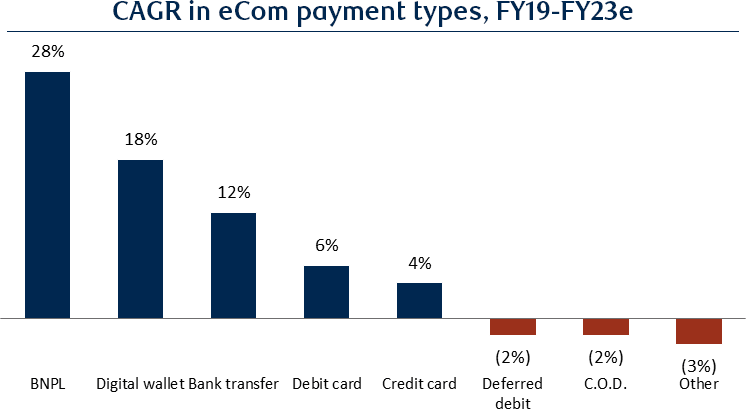

As Millennials and Generation Z shun credit cards and embrace e-commerce, the BNPL market is expected to grow exponentially. In 2019, the $60B BNPL market represented 2.6% of global e-commerce (ex-China); Worldpay estimates that it could grow at a CAGR of 28% to reach $166B by 2023. Digital wallet, the next most popular e-commerce type, is expected to grow at a CAGR of 18%.

The appeal of BNPL extends beyond consumers to merchants as well. Many retailers are increasingly turning to online point-of-sale (POS) because it increases conversion rates 20-30% and lifts average ticket sales 30-50%.

Source: FIS Worldpay, U.S. Census, Experian, Fiserv, RBC Capital Markets estimates

Spike in online shopping and mobile delivery transforms POS systems

The coronavirus upended consumers’ lives in ways that have trickled into their spending habits.

Sheltered at home, many turned to online shopping and mobile delivery services. For example, from the period before to during the pandemic, consumers’ use of online grocery and mobile takeout services increased 7% and 12%, respectively. To meet the demand, merchants added services such as order-ahead and curbside pickup.

“From the period before to during the pandemic, consumers’ use of online grocery and mobile takeout services spiked 7% and 12%, respectively.”

Dan Perlin, Managing Director – Payments, Processors and IT Services Research, RBC Capital Markets

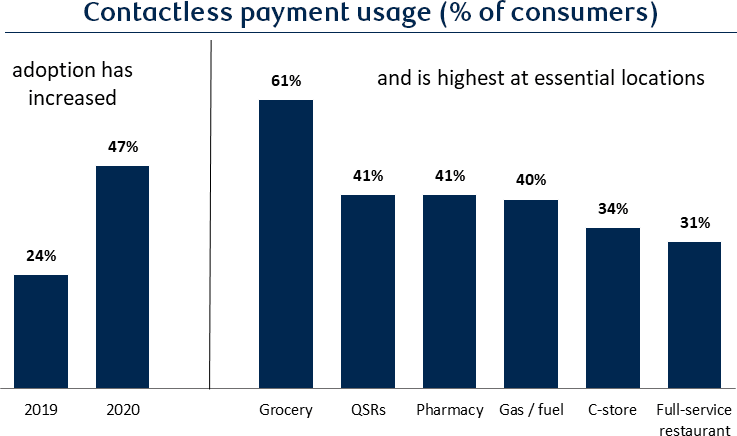

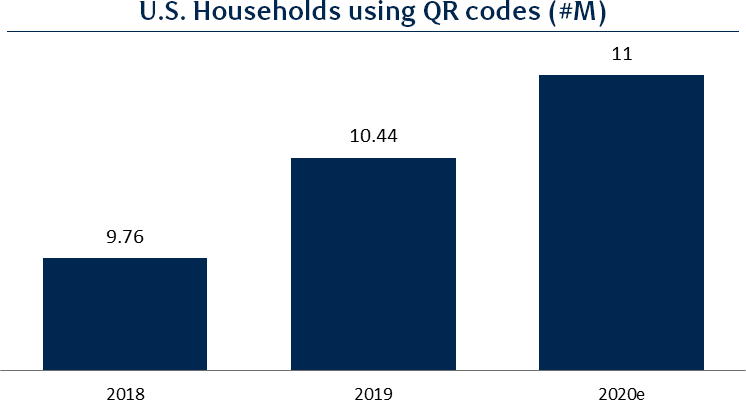

This surge in frictionless commerce and mobile adoption has redefined traditional POS systems. Mobile POS systems allow businesses to accept a wide range of “cashless” payments from anywhere with an Internet connection. For example, mobile wallet providers allow customers to pay directly from their smartphones using POS scanners to read barcodes or QR codes on their screens.

Advancements in mobile POS and payments will increase demand for both omnichannel payment technology that is consistent with customer experiences, as well as POS systems that can integrate online and offline transactions.

Source: PSCU, Statistica, RBC Capital Markets estimates

Consumers prefer ease and efficiency of apps over conventional banking

Consumers’ confidence in banks to manage and protect their finances has been steadily eroding; From 2018 to 2020, trust levels declined from 43 to 29%. As more customers choose Fintechs for simplicity, efficiency, and lower costs, many tech companies are expanding banking-type services to include payments, savings, and investments.

We predict large technology companies will also make a bigger push into the banking arena by either acquiring payments companies or offering bank accounts or other competitive payments services.

As digital banking takes hold, digital and cloud solutions gain traction

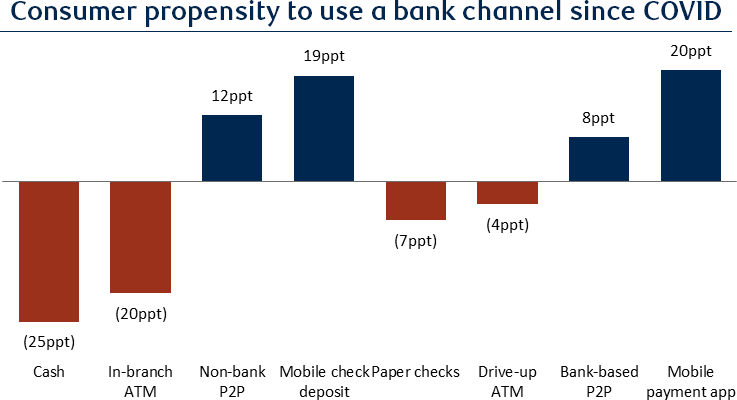

Younger generations once drove the popularity of digital banking. But online banking has now been embraced by all age groups, particularly age 50+ “Silver Tech” consumers, who emerged as frequent users during the pandemic.

“Online banking has been embraced by all age groups, particularly age 50+ “Silver Tech” customers who emerged as frequent users during the pandemic.”

Dan Perlin, Managing Director – Payments, Processors and IT Services Research, RBC Capital Markets

As banks and ATMs become less important distribution points and tech companies gain traction, banks have shifted investment dollars away from traditional distribution to digital channels and the customer banking experience.

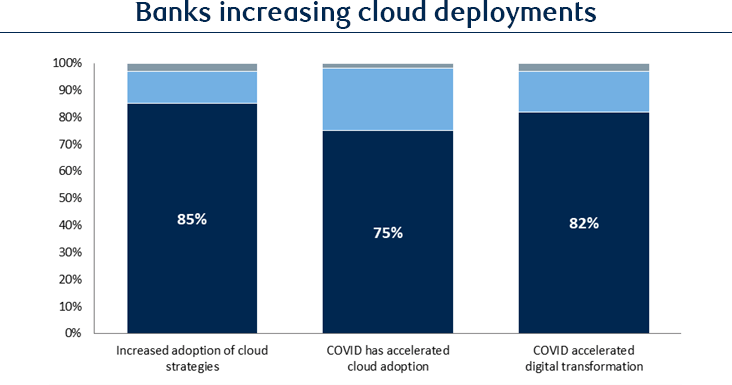

Cloud services are also gaining traction, as banks discover that cloud deployment can reduce costs, improve resiliency, and offer updated customer-facing applications.

Source: Accenture, EFMA, RBC Capital Markets

Cyclical exposure and digital enablers may lead post-pandemic recovery themes

We believe the following attributes will be among the key themes for post-pandemic recovery:

- Cyclical exposure, including those with exposure to physical retailers, restaurants and hospitality, international travel, and B2B payments

- Underperformance since 3/15/20, including stock price and estimate changes (through close of 12/21/20)

- Digitally-enabled names or those that help other companies become digitally enabled